We hope this page provides you with a helpful introduction to your Medicare coverage options.

Your taxes have paid for your Part A (Inpatient) of Medicare, and the standard monthly Part B premium (Outpatient) of $185 is normally deducted from a retiree’s Social Security check.

You have two coverage options outside of Original Medicare: Medicare Advantage or Medicare Supplemental insurance.

We can discuss either of these options with you and review your prescription drug plan choices.

What are my Medicare coverage choices?

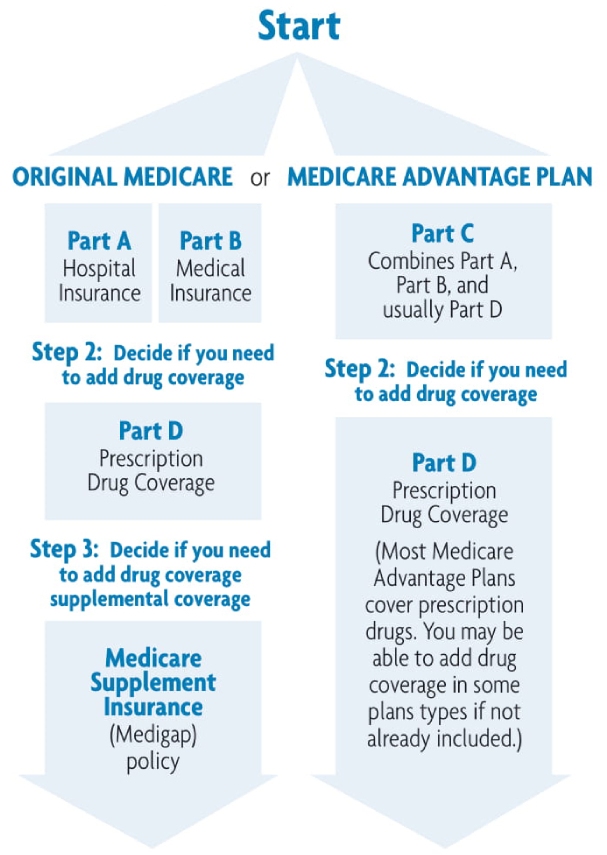

There are two main ways to get your Medicare coverage: Original Medicare or a Medicare Advantage Plan. Use these steps to help you decide which way to get your coverage.

Medicare Part A

Part A will pay for inpatient hospital stays after a $1,676 deductible.

Part B

Medicare is basically an 80/20 plan with deductibles. Part B will pay 80% (after an annual deductible of $257) for outpatient physician and surgical services, tests, therapy, diagnostic procedures and more.

Part C Medicare Advantage

Combines A, B & D. Medicare pays the company you select around $1,050 monthly so your monthly premium is often $0 (depending on which plan you choose), and you pay copayments.

Part D Drug Coverage

Part D Drug coverage will be included in your Medicare Advantage

or

can be purchased separately if you enroll in a Medicare Supplement.

There are 2 Phases of Medicare Part D Drug Coverage:

- Initial Phase – You will pay copayments or coinsurance for covered Part D Drugs. Some plans will have a $590 deductible. This phase ends when the member has reached the out-of-pocket maximum threshold of $2,000.

- Catastrophic Phase – The member pays no cost sharing for covered Part D drugs.

You can choose a Medicare Advantage Plan or a Medicare Supplement

Advantage Plans often do not have a monthly premium and drug coverage is included. This is because Medicare pays the insurance company directly to handle your health care. You will have co-payments.

Medicare Supplement insurance will pay the gaps in Parts A and B or Medicare. You will have to pay a monthly premium for supplemental insurance and a separate drug plan.

Get Your Custom Quote: Fast, Easy, and at No Additional Cost

Contact us today to schedule your consultation.

It does not cost any extra to have an agent representing your best interests.

And there’s no obligation – just honest, helpful information you can depend on. All in as little as 25 minutes.

Phone:

(440) 210-4077

Address:

13374 Ridge Rd.

North Royalton, OH 44133